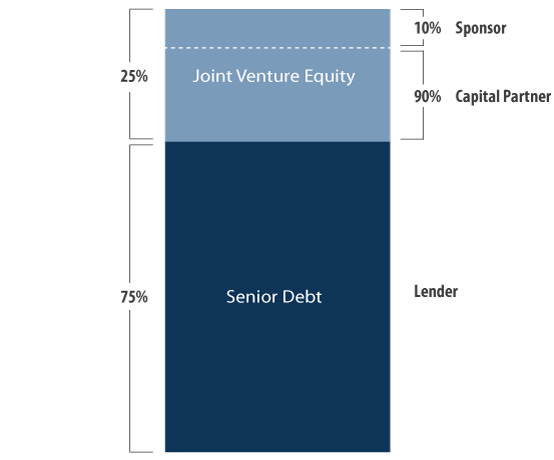

Equity that involves investing capital directly in the ownership of the partnership is referred to as Joint Venture Equity or JV Equity. Providers of Joint Venture Equity are referred to as “Capital Partners” who will typically invest 50% to 90% of the total required common equity. The developer or real estate investor who is seeking the joint venture equity is referred to as the “Operating Partner” or “Sponsor”. Operating Partners usually provide 10% to 20% of the total required equity in exchange for a specified “carried interest” or “promotion” ranging from 10% to 40%.

The investment period or horizon offered by providers of JV equity is typically three to seven years. New ground-up construction, value-add acquisitions, and rehab/redevelopments are the type of transactions best suited for JV equity. Conversely, existing stabilized cash flowing properties with low capitalization rates and low expectations of capital appreciation are usually considered ill-suited for joint venture equity. The structure and complexity of joint venture equity typically varies based on the type of property and the level of risk associated with the type of transaction. The chief elements or unique characteristics of joint venture equity most often include the following:

- Minimum Preferred Return or IRR Hurdle

- a “Waterfall” type of cash flow distribution

- Operating Partner/Sponsorship “Promotion” or “Carried Interest”

- Custom-tailored “partnership operating agreement”