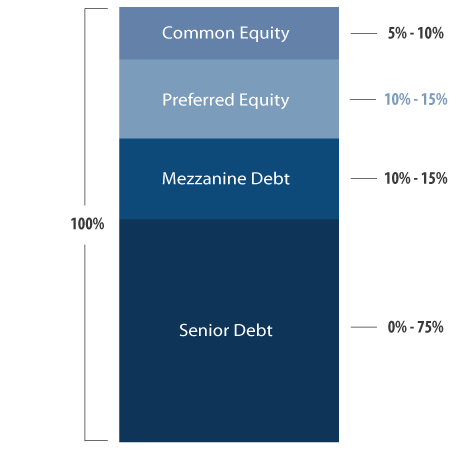

Preferred equity is another type of nontraditional real estate financing used by property owners to fill the “gap” between the senior mortgage and the property owner’s cash down payment (property owner’s cash equity contribution).

Unlike mezzanine loans preferred equity lenders become an equity owner in the partnership with special “preferred” rights and remedies. In exchange for the capital contribution, the preferred equity lender will be placed in a senior position to that of common equity owners and will be given certain control rights. Preferred equity lenders do not have any foreclosure rights, instead they possess superior contractual rights (provided in the partnership operating agreement) with respect to cash distributions and repayment of principal. In general, preferred equity financing will commonly consist of the following special “preferred” rights and remedies:

- The right to receive a “ preferred rate of return” on its capital investment

- The right to an accelerated repayment of its initial capital contribution (its original principal)

- “Change of Control Event” – a specific contract remedy set forth in the organizational documents in the event of a financial delinquency.

Preferred Equity Criteria

- $1 million – $25 million

- Major Markets Nationwide

- 50% – 90% of Total Equity

- Up to 90% of Total Capital

- Minimum Sponsor Participation: 10%

- 8% – 10% Preferred Rate of Return

- 12% -18% IRR (Total Return)

- 1-5 year terms

- Combined DCR 1.10x

- Current Pay & Accruing Options Available

- Purpose: Acquisitions, Debt Restructuring, Recapitalization, Value-Add & Repositioning, Partner buyouts, Distressed Purchases of Un-stabilized Properties